accumulated earnings tax form

Improperly accumulated earnings tax IAET in the Philippines is imposed upon every corporation formed or availed for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and earnings and profits to accumulate instead of being divided or distributed. It has no counterpart on Form 1120 because a C corporation does not have these accounts.

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

. Also use Form 8275 for disclosures relating to preparer penalties for understatements. A regular C corporation distributing its earnings out of retained earnings is considered a dividend. O Is the partnership required to file Form DTF-686 or DTF-686-ATT for this filing period to report a reportable transaction New York reportable transaction listed transaction or registered tax shelter.

Distribution from S Corporation Earnings. An irrevocable trust that retains earnings and has discretion in the distributions pays a trust tax of 3146 plus 37 of amounts exceeding. Consolidated Statements of EarningsFirst Quarter 2022 and 2021 4.

The accumulated after tax profits can be used to pay off corporate debt or for working capital to operate or grow the business instead of opening a Line of Credit loan. It is not a reconciliation of retained earnings as the schedule M-2 is for an 1120. 3 Post-1986 earnings and profits The term post-1986 earnings and profits means the earnings and profits of the foreign corporation computed in accordance with sections 964a and 986 and by only taking into account periods when the foreign corporation was a specified foreign corporation accumulated in taxable years beginning after.

The entire 20000 distribution represents a tax-free reduction of As basis in S Co. IRM 48821 Accumulated Earnings Tax discusses that the burden of proof is on the Commissioner unless a notification is sent to the taxpayer under IRC 534 b. Because the distribution reduces As basis in the S.

Form 870-T will be used for income tax cases. Form 2504 will be used for employment or excise tax. The 1120S schedule M-2 analyzes adjustments to the accumulated earnings account other adjustments account and previously taxed income account.

Income tax expense 1227 2688 Net earnings 5585 11840 Earnings attributable to noncontrolling interests 125 129 Net earnings attributable to Berkshire Hathaway shareholders 5460 11711. Recorded Tele-Tax Service on federal tax topics or tax refund information is available by calling. Federal tax forms and publications are available by calling.

C corp shareholders receive Form 1099-DIV and they will in turn report the dividend on their individual federal tax return. CE a global chemical and specialty materials company today reported GAAP diluted earnings per share of 403 and adjusted earnings per share. 23 In addition to reviewing the Schedule M-2 Analysis of Unappropriated Retained Earnings per Books from a corporations annual Form 1120 a detailed analysis of.

However only the distributions made from current or accumulated EP will reduce EP. An S corporation does not generate EP. How to File a 5471 Extension.

Generally the E. A tax imposed by the federal government upon companies with retained earnings deemed to be unreasonable and in excess of what is considered ordinary. DALLAS July 28 2022--Celanese Corporation NYSE.

A Corporation or an LLC that elects C Corporation tax status can retain up to 250000 without having to justify and pay a higher tax rate on its accumulated earnings. O Yes No If Yes complete and submit Forms DTF-686 DTF-686-ATT and any applicable federal forms. However the taxation of distributions is more complicated if the S corporation has C corporation accumulated earnings and profits EP.

Form 5471 is Filed when the Tax Return Due. The Form 5471 is due to be filed at the same time the taxpayer files their tax return. Federal Tax Assistance Federal tax account or technical information and problem solving are available by calling.

The amount in the IRC 125 Box is subject to New York State and City taxes. The NYS income tax instructions direct the income tax filer to report wages as they appear on the W-2 in Box 1 then to add back the amount to arrive at New York StateCity taxable wages. Form 5471 Schedule J Accumulated Earnings and Profits EP of Controlled Foreign Corporation 2018 Form 5471 Schedule J Accumulated Earnings and Profits EP of Controlled Foreign Corporation 2012 Form 5471 Schedule M Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons.

S corporations in general do not make dividend distributions. If a taxpayer requires an extension of filing Form 5471 then they would file an extension on Form 4868 for their regular tax return and then the 5471 will go on extension as well. Subsequent distributions by the S corporation to the shareholders often can be made tax-free.

Accumulated Earnings Tax. Made to avoid the parts of the accuracy-related penalty imposed for disregard of rules or substantial understatement of tax. The reduction in earnings shows on your W-2 but not on your pay statement.

Accumulated other comprehensive income 4428 4027.

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template

What Are Accumulated Earnings Definition Meaning Example

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Form 5471 Schedule J Accumulated Earnings Profits E P Of Controlled Foreign Corporation Youtube

What Are Earnings After Tax Bdc Ca

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Earnings And Profits Computation Case Study

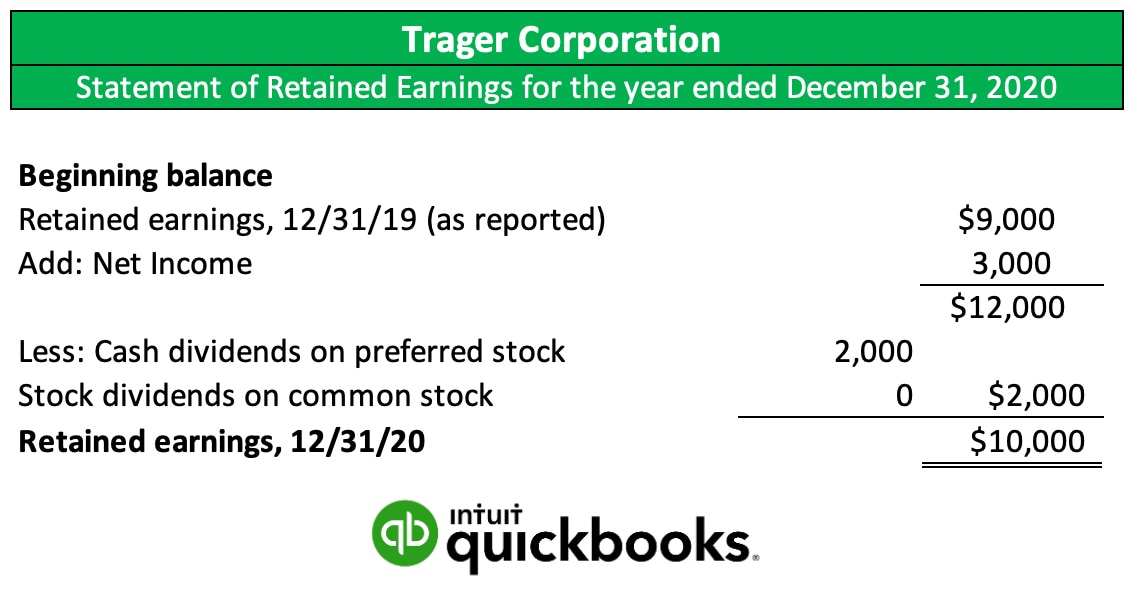

What Are Retained Earnings Quickbooks Canada

Determining The Taxability Of S Corporation Distributions Part Ii

Retained Earnings Formula And Calculator Excel Template

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)